Presently, commercial banks offer various bank products to its customers, 0% installment and terms are one of the most popular issues. Often, banks lead advertising campaign describing 0% installment terms, which are mostly mistakenly understood by some people. Presently, as some part of the society consider, in case of 0% installment, they pay only initial price of the trade center (as the interest is 0%).

"Society and Banks" focused on the terms of 0% installment of the commercial banks and doubled checked people's views around the issue.

Terms of such installment vary not only according to the banks, but according to the various trade points as well. Thus, we shall try to make a general overview of the given issue.

It is true that interest rate of interest-free installment is zero, though at the moment of purchasing the product, customers have to pay the commission of the loan approval/issuance and extra charge. Such expenses increase the initial price of the product. Period of interest-free installment varies between 3-36 months for all banks and amount of loan between 100-5000 Gels. For verifying what we really pay for the product, let's discuss several examples:

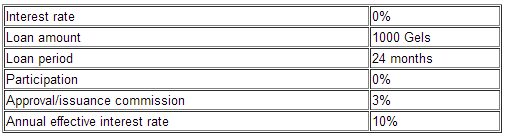

Table 1: 0% installment example #1

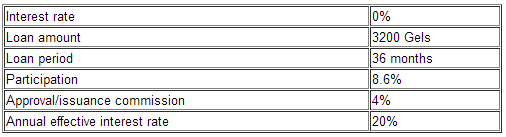

#2 Table: 0% installment example #2 Now, if we want to buy an oven and visit the trade point, where we can buy with 0% installment, definitely interest rate is 0% as the installment is interest-free. Initial price of the oven is 950 Gels, but as we want to buy it with 0% installment, trade point rises the price and sells for no less than 1000 Gels. We choose loan period of 24 months (period for covering the loan); in this case, participation is 0% (amount of sum payable at the moment of purchase, without any installment), issuance commission - 3% and respectively, effective interest rate - 10%. Thus, we pay 3 % of 1000 as a single payment - 3o gels and price of the product - 1000 Gels will be equally distributed over 24 months period and we have to pay 41.6 per month. Correspondingly, we have to pay 1030 Gels for the oven. If we buy the oven instantly, without any installment, then we have to pay only 950 Gels and in case of installment, we have to pay 80 Gels additionally i.e. 1030 (50 Gels extra charge and 30 Gels for loan issuance).

Conclusion In case of #2 example, we would like to buy a TV Set. Interest rate is still 0% in this case and we purchase with interest-free installment. Let's presume that the initial price of the TV Set is 3200 Gels, but as we buy it with installment, shop rises price with 300 Gels and we cannot buy the product less than 3500 Gels. Let's say that the loan period is 3 years (36 months), participation is 8.6% i.e. 8.6% of 3500 - 300 Gels we pay initially and 3200 Gels as interest-free installment. 4% is the commission for loan issuance and we pay 128 Gels - 4% of 3200 Gels as a single payment and the price of the TV set is distributed over 36 months, equally and we pay 88.8 Gels per month. Thus, totally customer pays 3628 Gels for the TV Set. If w buy the TV Set without installment, then we have to pay only 3200 Gels and in case of interest-free installment 3628 Gels - 428 Gels more, whereas 300 Gels is an extra charge and 128 Gels commission for the loan

After the research, we have verified that terms of interest-free installment vary not only according to the banks, but according to the various trade points as well. Though, period of interest-free installment varies between 3-36 months for all banks and amount of loan between 100-5000 Gels. In case of interest-free installment, costumer pays extra charge and commission of the issuance of the loan. If the commission is 0%, then extra charge is higher and vice versa; if the extra charge is low, then commission is higher. If the customer is unable to pay the commission at that moment, then interest rate increases and it will be allocated over the months.

Generally, one can provide various combinations of commission, participation percent, loan amount and period, which depends on the bank and specific trade center/point. In any case of the interest-free installment, customer pays more than the initial price of the products, depicted in the extra charge and loan commission fee.

Hereby, we concluded that the notion spread among some part of the society saying that "largest part of the commercial bank assets consists of foreclosed immobile and mobile property" - is false.

Opinions checked by Bankometer. See the video